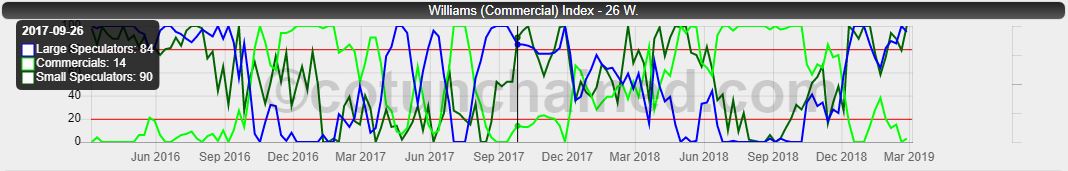

The Williams Commercial Index, also known by the short name WillCo Index, was developed by Larry Williams to analyze the

positioning of commercials on the futures markets. Unlike the CoT index

weighted the WillCo index relative to the overall market.

For this, the net position of a market participant is initially divided by the total

Open Interest at the time of the respective net positon. In order to calculate the oscillator, these data will be used in the following as in the CoT index

set in ratio to the highs and lows within a selectable period. As default

26 weeks were chosen here. This corresponds to the period proposed in the books of Larry Williams.

For the Williams Commercial Index, calculate the quotient for each week:

These are then used to calculate the oscillator: