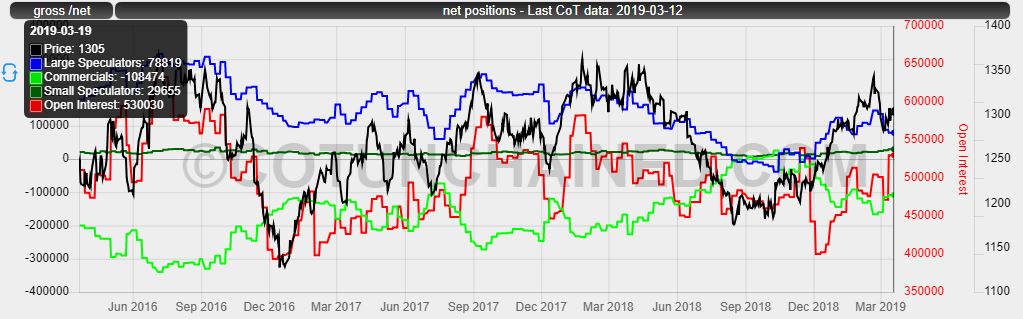

The Commitment of Traders Report (CoT) is published every Friday evening by the Commodity Futures Trading Commission (CFTC) and reports on the trading positions of market participants at close of trading on Tuesday evening of the current week. Until September 4, 2009, these have only been divided into three groups:

Commercials

These are the large traders who primarily hold hedging positions such as commodity producers and swap dealers.

Large Speculators / Non Commercials

Large market participants who primarily place speculative positions for profit. These are also reportable like the Commercials. These include, for example, large funds and speculators who take very large positions.

Small Speculators / Non Reportables

Summary of all other market participants that are not notifiable and whose positioning is therefore calculated from the difference between the total open interest and the reportable market participants. eg small speculators who are usually represented by small traders.

This report is referred to as the Legacy Report and is available for download on the CFTC's website until the year 1986.

Since 04.09.2009 also the so-called Disaggregated Report is published in which the commercial traders and the large speculators are further broken down. The so-called Disaggregated Futures Report, which is prepared only for the commodity markets, divides the commercials into producers and swap dealers, the large speculators into money managers and other reportables. The Traders Financial Futures Report is divided into Dealer / Intermediary, Asset Manager / Institutional, Leveraged Funds and Other Reportables. The data of the legacy report can not be calculated in the financial futures via a simple addition of the data of the trader in financial futures reports, since the market participants are summarized differently. Subsequently, this report was also identified and provided for the years 2006 to 2009.

Note: Opinions differ widely about the significance of CoT reports. Especially here is criticized that these reports are already outdated when published. In addition, the data is poorly useable for short-term trading due to its weekly release.

Source: https://www.cftc.gov/